The finance industry sees rapid swings, and these changes can make hiring a financial advisor overwhelming. As a recruiter, you’re expected to find professionals who have the technical expertise to manage complex portfolios and the people skills to build lasting trust. With evolving skill sets, licensing requirements, and new business demands, it’s easy to lose sight of what your ideal candidate should look like.

In this article, we’ll break down the hiring process, exploring the challenges recruiters face when bringing on new advisors, proven strategies to attract top talent, and the best practices for retention. But before diving into recruitment, we’ll first look at who a financial advisor is, the core financial advisor skills they need to succeed, and the responsibilities that define the role

Who is a financial advisor?

A financial advisor is a licensed professional who manages an individual or company’s financial assets and resources. They help clients make informed decisions about their money and ensure long-term financial growth and security.

This could include guiding investments, tax strategies, retirement planning, and overall wealth management. However, financial advisors do more than crunch figures; they also serve as trusted financial partners for their clients, earning their confidence and strengthening the firm’s reputation.

Skills of a good financial advisor

A financial advisor is only as effective as the skills they have.The right financial advisor skills are what separate someone who merely manages accounts from an advisor who drives real, transformative financial growth. Below, we’ve outlined the top financial advisor skills to prioritize when hiring.

1. Financial analysis

Fluctuations in markets and business climates can create changes in data points, uncertainties, and risk. Financial advisors should be able to study complex financial data, analyze it, and make informed recommendations suited to the client’s interests.

They should foresee and adapt to changing economic conditions, identify potential risks or challenges, and develop strategies to help the client reach their financial goals.

2. Wealth and investment management

A company’s revenue shouldn’t remain stagnant; sustainable growth depends on increasing both assets and disposable income. Advisors with strong wealth and investment management skills are able to evaluate a wide range of investment vehicles and assets, their potential benefits, and associated risks. Using this knowledge, they can design and manage a healthy, diverse portfolio that grows and preserves wealth in the long run.

3. Sales and business development

Beyond managing existing clients, top advisors also increase a company’s reach and attract new business. Sales and business development skills equip them to identify new opportunities, network effectively, and map out tactics that convert prospects into loyal clients. Additionally, recruiters should assess their ability to chart the company’s financial objectives periodically and track metrics to measure progress.

4. Relationship management

Besides technical skills, financial advisors need strong interpersonal skills to build and maintain client relationships. By listening closely, speaking clearly, and showing empathy, advisors signal to clients that their priorities truly matter. This fosters stronger relationships built on trust and loyalty, which ultimately strengthen your firm.

5. Ethics and trustworthiness

Financial advisors handle sensitive client information and manage significant assets, making integrity non-negotiable for this role. Recruiters should look for candidates who demonstrate transparency, honesty, and compliance with regulations.

An independent mindset is equally important, as it allows advisors to make sound decisions in the client’s best interest rather than being swayed by pressure or short-term gains. Without these skills, even experienced advisors could lead a company into financial ruin.

Challenges in recruiting financial advisors

Matthew Rady, BT chief executive, told Money Management, “One of the top concerns for advisers is finding and recruiting staff. We know we have a shortage of financial advisers in Australia.” Below, we’ll discuss some of the hurdles recruiters face that make this one of the most competitive roles to fill.

1. Industry competition

The finance industry currently faces a high rate of skills shortage, and several companies report an alarming advisor exodus. Every year, older executives step down, but few employees are well-equipped to handle their roles.

As a result, the financial advisors left are in high demand, with multiple firms competing for the same limited talent pool. This growing imbalance has made it increasingly difficult for organizations to secure and retain the right candidates.

2. Poor benefits and value propositions

Poor compensation often dissuades potential hires, especially for such a niche, demanding role. Skilled financial advisors spend money and time acquiring the requisite knowledge and licenses they need to deliver results. When companies offer packages that fail to reflect this value, especially compared to industry standards, they have little incentive to join or stay.

3. High attrition rates

Even after hiring skilled advisors, retaining them can be a significant struggle. Due to the extreme competition, many leave for firms that promise better compensation, richer benefits, or faster growth opportunities.

This challenge isn’t limited to firms with weak offerings, as companies with solid packages can struggle to compete with larger institutions. In other cases, advisors may simply tend to make frequent moves, causing high turnover and reducing long-term retention.

4. Technological changes

31% of leaders in Workday’s Global State of Skills study identify digital skills as a top area of concern in their workforce. AI is at the forefront of the global workspace today, and finance is no different.

Firms need advisors who can adapt quickly to modern digital tools like robo-advisors and AI-driven software, but few candidates keep up with these advancements. This creates a gap between what firms require and what many advisors are prepared for.

5. Culture fit

Besides technical skills, recruiters must hire advisors who have soft skills that fit and add to their team’s values. Many advisors, despite having technical expertise, have approaches that don’t align with the company’s culture. This culture-fit mismatch often leads to friction with teams or dissatisfaction among clients, making retention even harder.

Strategies for sourcing top financial advisors

To hire a skilled financial advisor, you need quality candidates in your talent pool, and this relies heavily on your sourcing techniques. Here, we’ll discuss four foolproof strategies for sourcing top financial advisors.

1. Employer branding

Your employer brand is the image and reputation your company projects to the outside world. It encompasses your results, public engagement, and how you present opportunities to potential hires.

Firms that project stability, growth, and a clear value proposition attract the best advisors. In a competitive market, you want your openings to stand out, and this requires a transparent, fair approach. Craft job descriptions that clearly outline the role’s requirements, responsibilities, and benefits, and prioritize a positive candidate experience throughout your hiring process.

2. Leverage existing network

Referrals and word of mouth can extend your reach to candidates who aren’t job hunting actively. Top advisors usually operate within professional circles and may have ties to your existing employees or clients. Offering referral incentives encourages your team to share open roles, giving you access to high-quality candidates you may not be able to reach through traditional postings.

3. Digital channels and job boards

Online platforms like LinkedIn, niche finance job boards, and professional associations give recruiters access to a broad candidate pool.

Posting detailed job descriptions and running targeted campaigns puts your open role on the radar and connects you with candidates who have the skills you need. Strengthen this by sharing thought leadership and engaging directly with candidates to build credibility and attract stronger applicants.

4. Campus recruitment and trainee programs

Experienced advisors are scarce and in demand, which makes building a long-term talent pipeline essential. Instead of focusing only on seasoned professionals, consider shaping new advisors early by bringing them in through universities and graduate programs.

Provide structured training, mentorship, and career development resources to equip them with the skills they need to succeed in your firm. This approach not only ensures advisors are trained to your company’s standards but also encourages loyalty from the start.

How to hire financial advisors for your firm

Sourcing candidates is only the first step. To build a strong advisory team, recruiters must focus on both effective hiring and long-term retention. Here’s how:

1. Evaluate candidates with skills assessments

While resumes provide a useful background, they often fall short of showing a candidate’s true capabilities. Skills assessments go beyond surface evaluation by objectively measuring a candidate’s financial knowledge, analytical ability, and interpersonal skills.

Assessment platforms like Vervoe take this further with assessments that mirror real financial advisory scenarios to reveal how a candidate would perform in practice. This lets you take a comprehensive approach to hiring and ensure you hire candidates who have the skillset necessary for effective performance.

2. Complement with behavioral interviews

Skills assessments show you a candidate’s true capabilities, but personal interaction is just as critical before hiring.

Use behavioral interviews to test their engagement and social skills, ensuring you hire candidates who can build relationships and demonstrate ethical judgment while carrying out their technical tasks. You can also conduct group interviews to observe how well they work in a team.

3. Invest in onboarding and training

A strong start sets the tone for employee retention. Structured onboarding, paired with continuous training in compliance, market trends, and communication skills, helps advisors feel supported and prepared to grow with the firm. When they’re confident that your company cares about their career development, they are more encouraged to remain long-term.

4. Create clear growth pathways

Top candidates are drawn to firms that offer room to grow and gain experience. Define internal mobility and promotion policies, whether through senior advisor roles, leadership tracks, or specialization areas, and communicate them clearly during recruitment. Showing candidates they have a future in your firm attracts talent, motivates them, and piques their interest in your firm, combating high attrition rates.

5. Build a supportive culture

No matter how attractive the job benefits are, culture plays a defining role in retention. Toxicity and an unwelcoming atmosphere hinder growth and repel candidates with a strong work ethic. Build an environment of harmony and synergy where advisors feel genuinely valued through mentorship, collaboration, and work-life balance. A supportive culture strengthens loyalty and creates the conditions for consistent, long-term results.

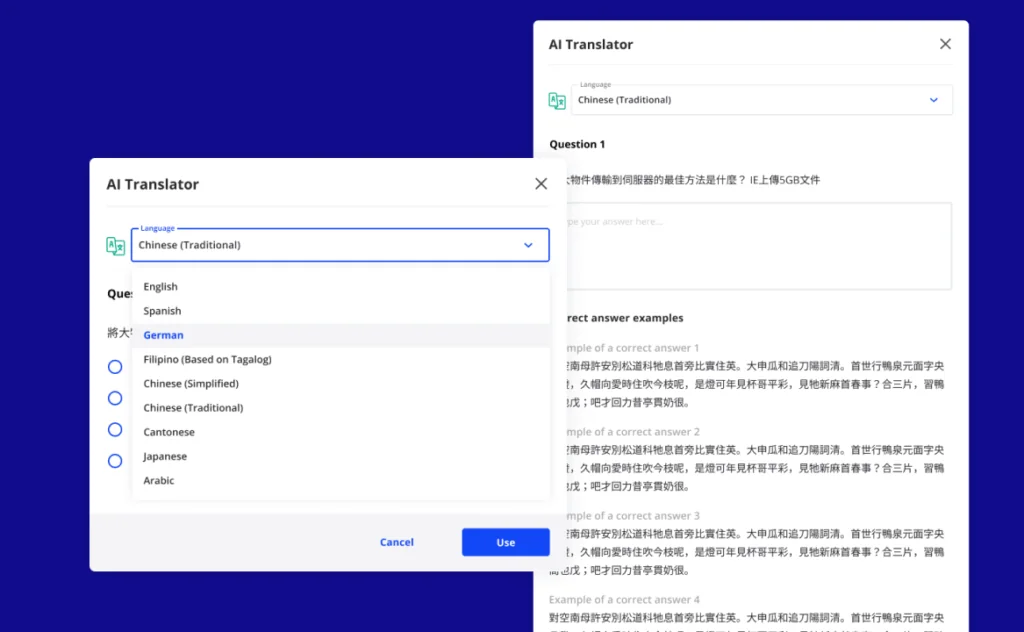

High-performing financial advisors start with Vervoe

Hiring financial advisors is no easy task, with recruiters needing to balance technical skills, certifications, and relationship-building ability. Skills assessment software like Vervoe simplifies your job and helps you hire accurately by letting you see how candidates perform in real-world scenarios before you hire.

With Vervoe, you get access to extensive evaluation features, including a rich assessment library, realistic job simulations, and transparent, skills-first AI grading that ranks candidates fairly. Our AI assessment builder also makes it easy to create tailored tests that fit your firm’s unique advisor needs.

Take the guesswork out of your recruitment. Book a free demo with Vervoe today and start building a stronger advisory team with confidence.